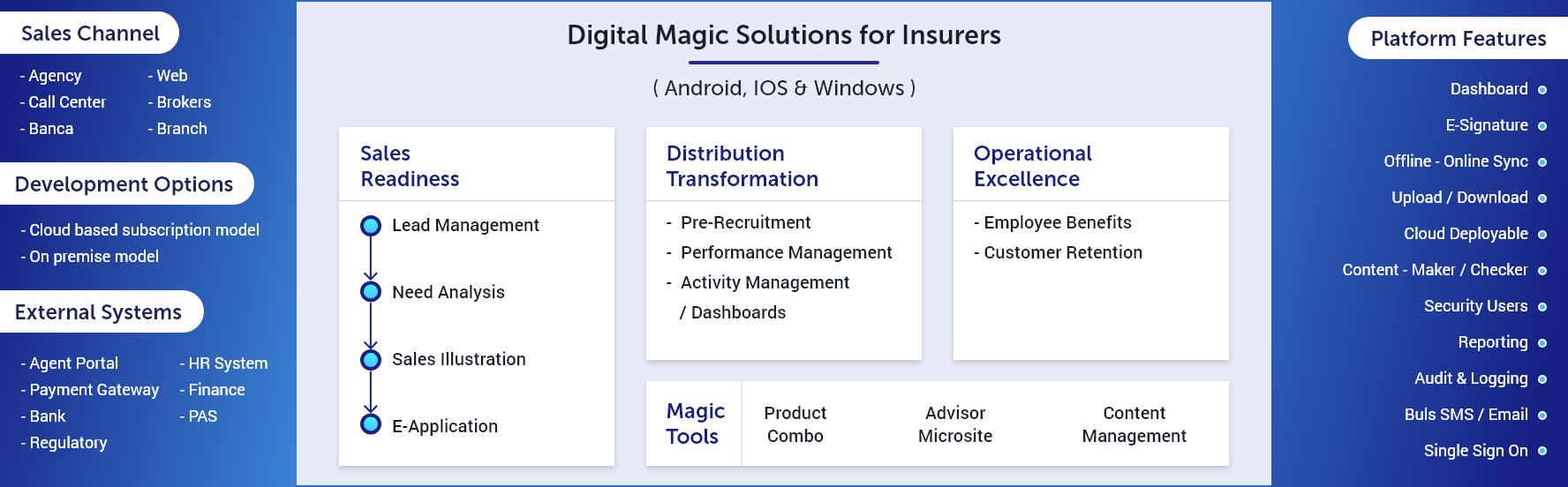

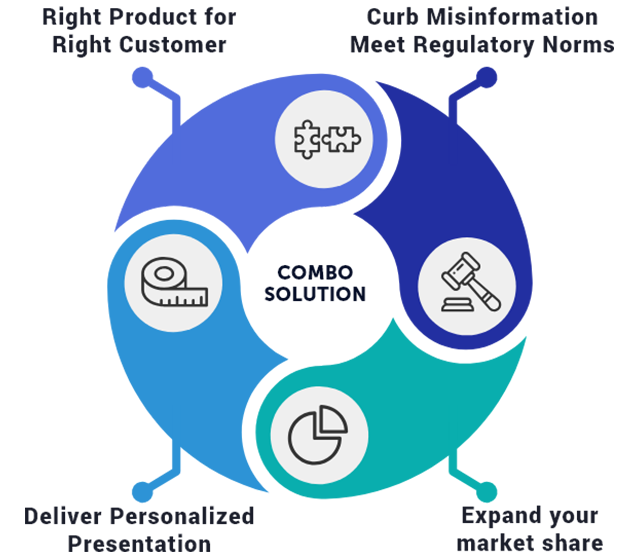

The enterprise-class solutions of Datacomp Web Technologies automate the end-to-end processes of insurance business. Classified into three broad categories Sales Readiness, Distribution Transformation and Operational Excellence-our top notch solutions deliver concrete benefits of speed, accuracy, and cost-efficiency to customer's organizations.

From Presales to Recruitment to Compliance to Customer Retention-our comprehensive solution stack addresses the specific business needs of insurance carriers , agents, and advisors.